utah state tax commission tap

If you have questions regarding appraiser licensing and certification call the Division of Real Estate at 801-530-6747. Sales.

Pay the IRS.

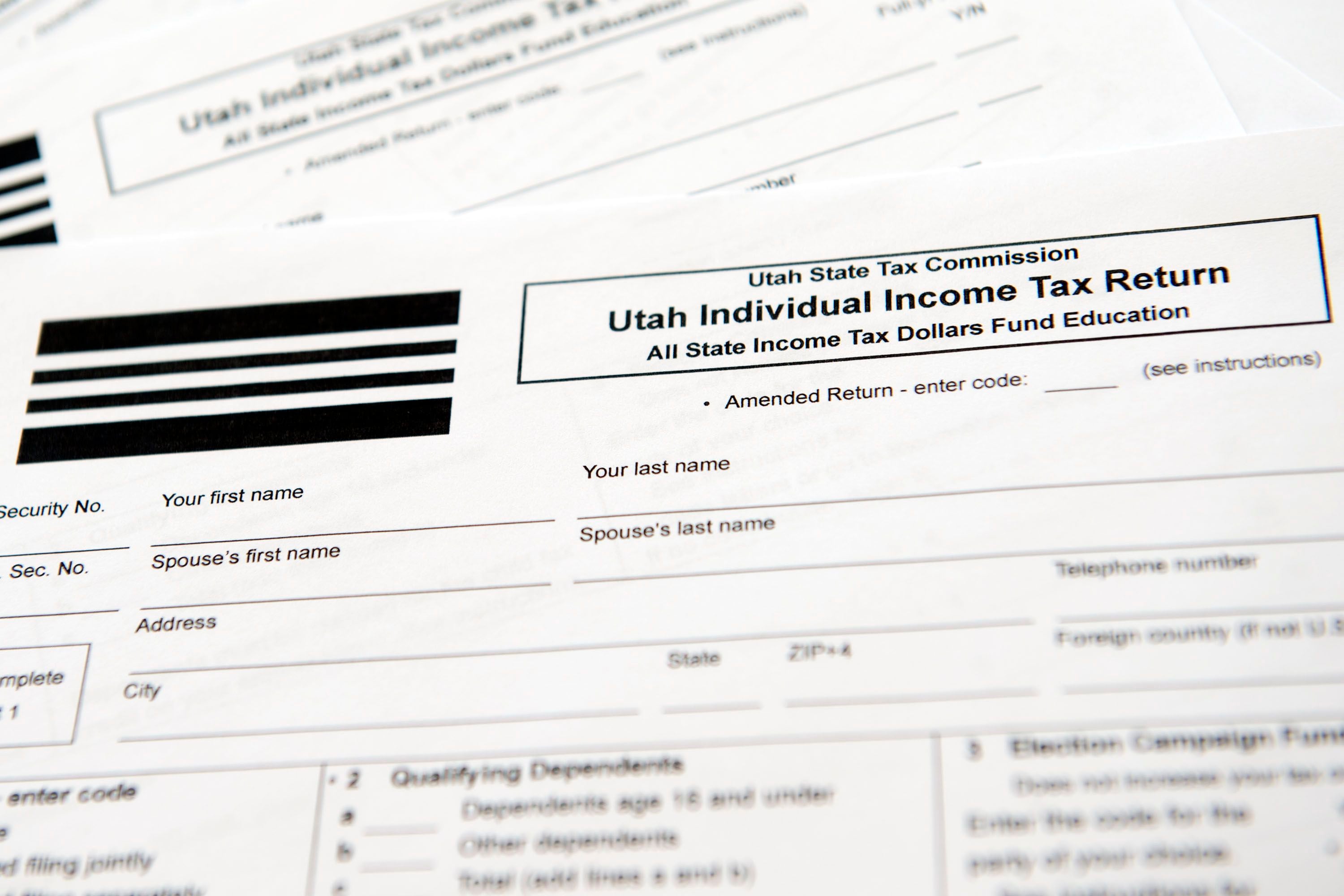

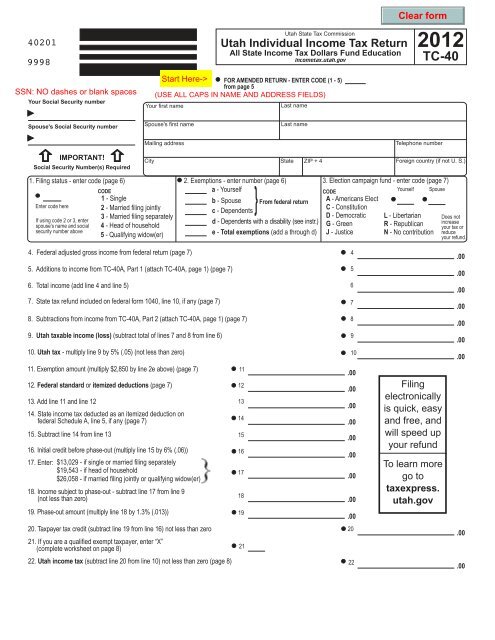

. Write your daytime phone number and 2021 TC-40 on your check. Utah State Tax Commission SFG PO Box. The Tax Commission cannot issue a refund prior to March 1 unless we have received both your return and your employers required return.

Automate manual processes and eliminate human error with Sovos tax wihholding solutions. All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday. Utah Tax Commission information registration support.

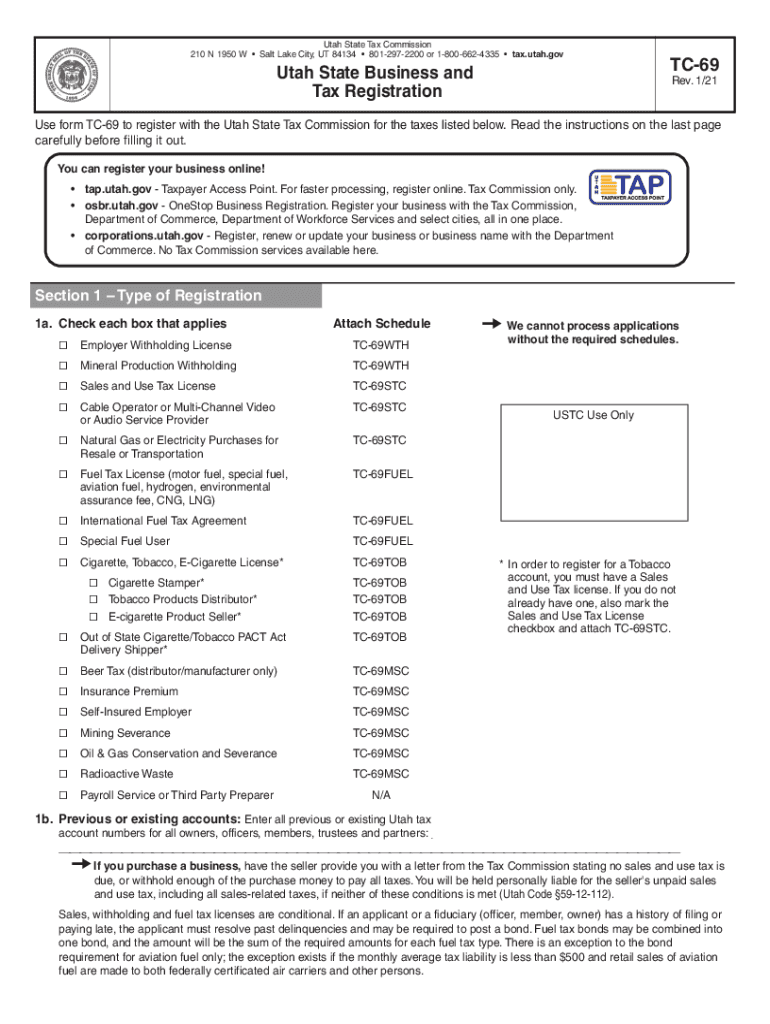

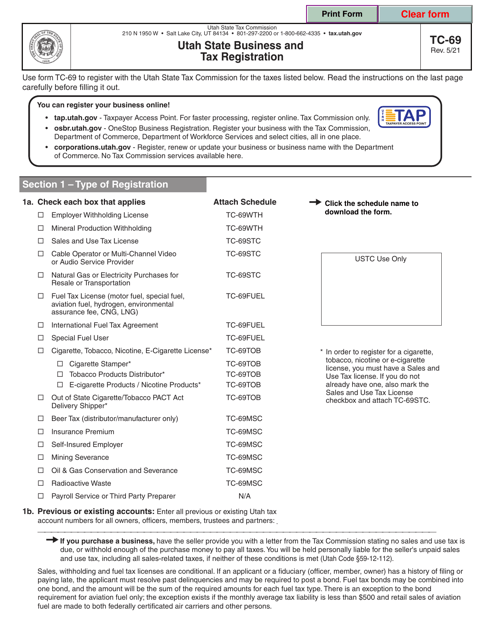

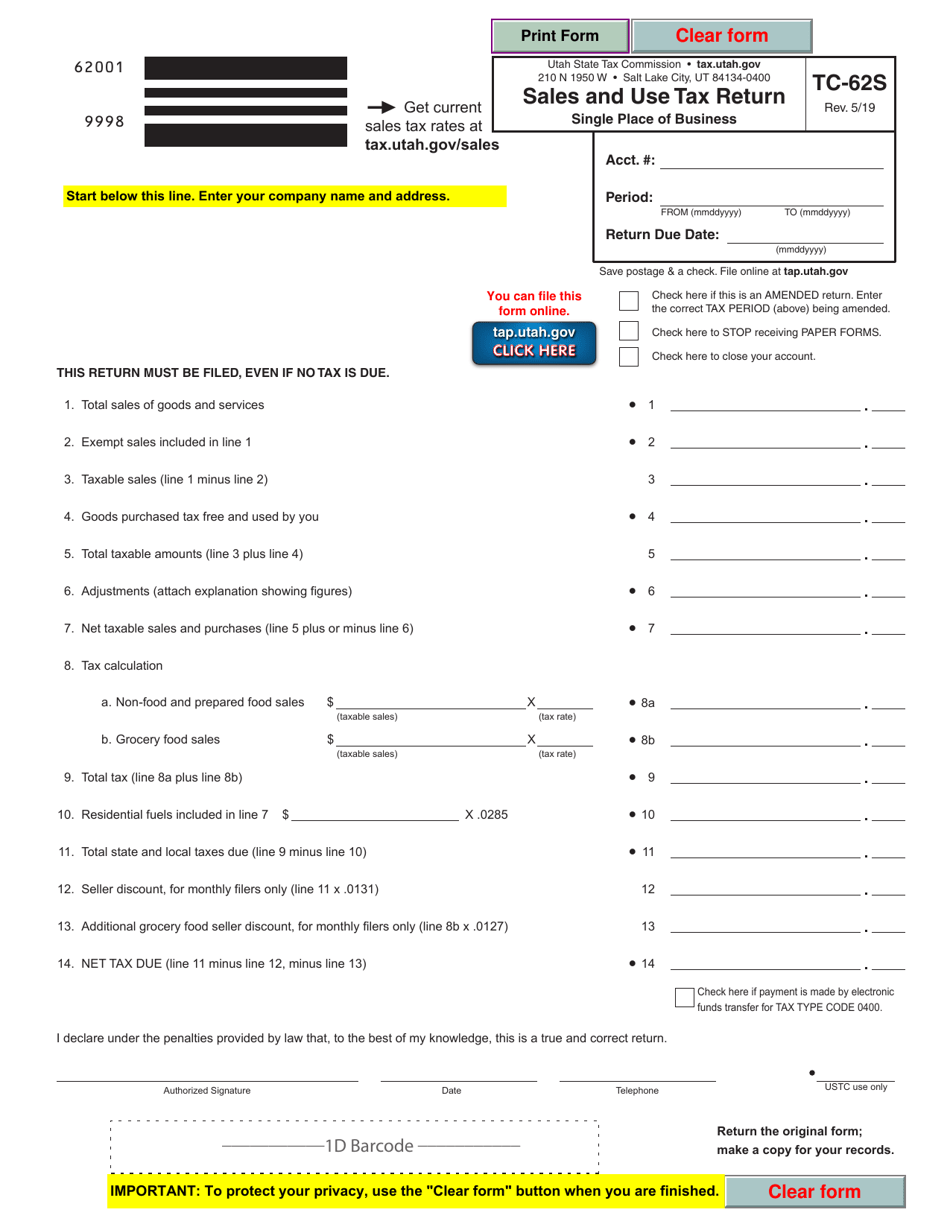

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. 210 North 1950 West. Ad Accurate withholding repotting to federal state and local agencies for all transactions.

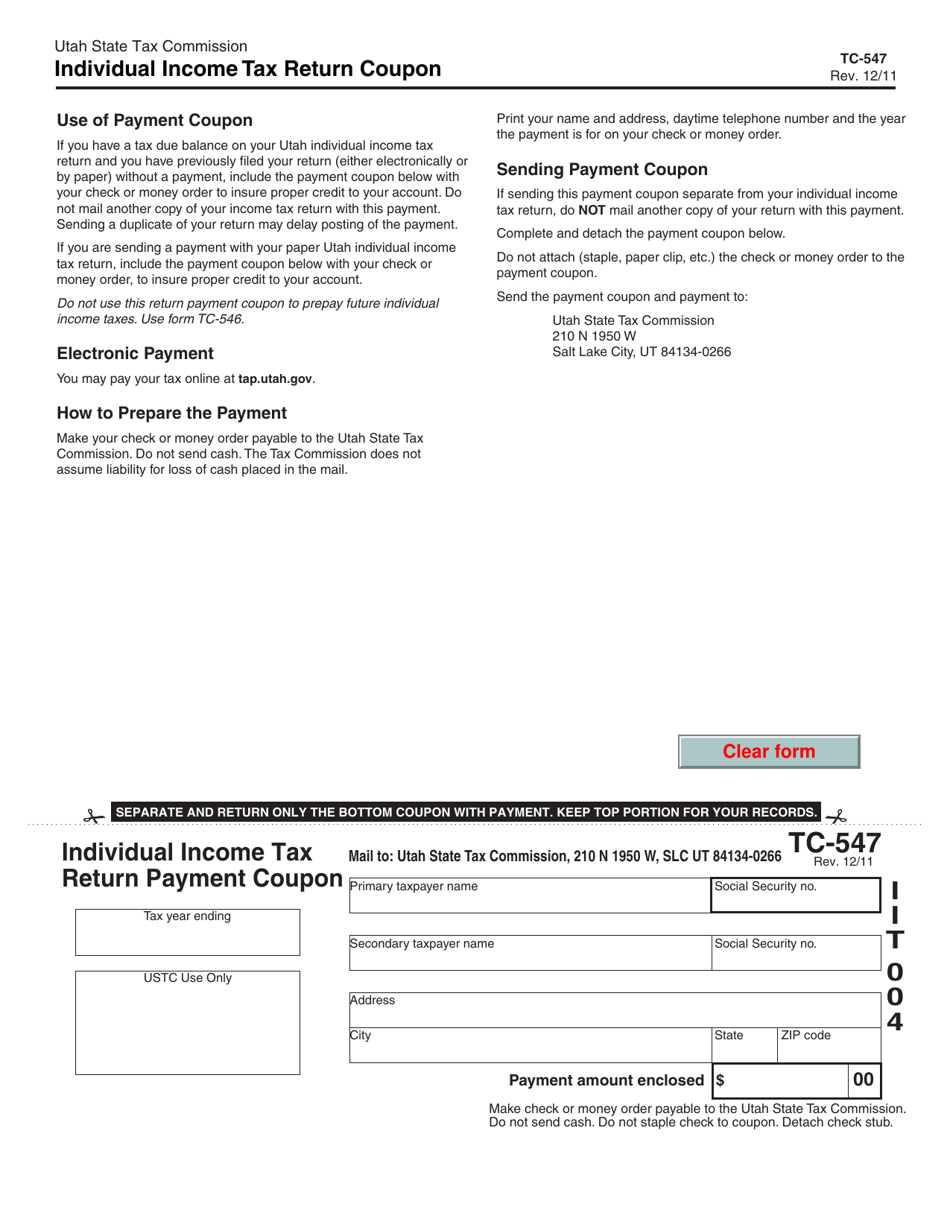

2022 Training Course Schedule. The Tax Commission is not liable for cash lost in the mail. Include the TC-547 coupon with your payment.

Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266. Ad New State Sales Tax Registration. For 2021 tax year returns only.

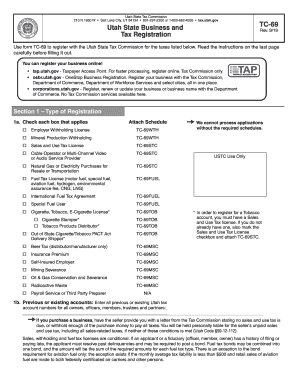

Ad Download or Email UT TC-69C More Fillable Forms Register and Subscribe Now. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed.

Tax Instruction. This will calculate penalties and interest for individual income or fiduciary taxes such as for late-filed or late-paid returns. Address Phone Numbers 210 North 1950 West Salt Lake City Utah 84134 Phone.

801-297-2200 or Toll Free. Official tax information for the State of Utah. Other Ways To Pay.

The letter will direct you to take the quiz on our secure website at taputahgov. You have been successfully logged out. Remember that the Annual Report and the Annual Return for Assessment is due March 1st each year.

Identity verification questions are based on information from your drivers license or state ID card and your Utah income tax returns for the previous one or two years if you had Utah tax returns for those years. File electronically using Taxpayer Access Point at taputahgov. You may now close this window.

Frequently asked questions about Taxpayer Access Point. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Official income tax website for the State of Utah with information about filing and paying your Utah income taxes and your income tax refund.

Due to our efforts to protect your identity please allow 120 days from the date you filed your return or 120 days from March 1 whichever is later to process your return and refund request. If you have questions regarding the education classes or the appraiser designations contact Tamara Melling Property Tax Education Coordinator at 385-377-6080 or tmellingutahgov. Do not staple your check to your return.

Utah State Tax Commission 210 North 1950 West Salt Lake. Remove any check stub before sending. TAP help manual detailed help for using Taxpayer Access Point.

For security reasons TAP and other e-services. Do not mail cash with your return. In accordance with Utah Code Annotated 59-2-202 each centrally assessed Utility and Transportation taxpayer must annually file on or before March 1 a completed Annual Report and an Annual Return for Assessment with the Property Tax Division of the Utah State Tax.

It does not contain all tax laws or rules. Interest on any underpayment deficiency or delinquency of any tax or fee administered by the Commission shall be computed from the time the original return is due excluding any. Taxpayer Access Point TAP.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Motor Vehicle Enforcement MVED. File electronically using Taxpayer Access Point at taputahgov.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. You can pay business income taxes in person at one of the Utah State Tax Commission Offices or via mail to.

Utah State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Utah State Tax Information Support

Ut Tc 69 2021 2022 Fill Out Tax Template Online Us Legal Forms

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong

Where S My Refund Utah H R Block

Utah State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Form Tc 62s Download Fillable Pdf Or Fill Online Sales And Use Tax Return For Single Places Of Business Utah Templateroller

Utah State Tax Commission Official Website

Form Tc 40 Utah State Tax Commission Utah Gov

Utah State Tax Commission Official Website

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong

Itap Utah Form Fill Out And Sign Printable Pdf Template Signnow

Form Tc 547 Download Fillable Pdf Or Fill Online Individual Income Tax Return Payment Coupon Utah Templateroller

Utah State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller